The housing market is an ever-changing landscape, with interest rates playing a significant role in determining the affordability and availability of mortgages which directly affects the buying power of potential homebuyers. In this blog post, we will delve into the current mortgage rate environment and understand strategies for navigating interest rates in real estate transactions.

Current Mortgage Rate Environment

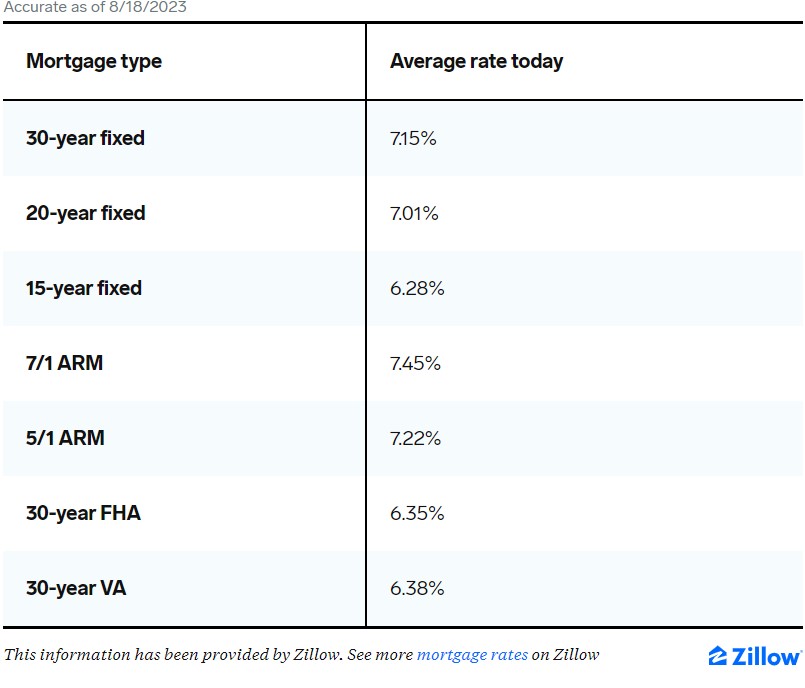

Mortgage rates continue to climb this week, with the 30-year fixed rate reaching its highest level since 2002, adding pressure to buyers who are already grappling with high costs and low inventory. The current average rate for a 30-year fixed mortgage climbed 2 basis points from 7.13% to 7.15% on Friday. That’s about 28 basis points up from the previous week’s average of 6.87%. Additionally, the current national average 15-year fixed mortgage rate also increased, rising 2 basis points from 6.27% to 6.29%. The current national average 5-year ARM mortgage rate rose 4 basis points from 7.16% to 7.20%.

The rising current mortgage rates is being driven by a number of factors, including the Federal Reserve’s efforts to yank the inflation rate back to its 2% goal. The Fed has raised home mortgage rates several times this year, and is expected to continue to do so in the coming months. This is putting upward pressure on mortgage rates, as well as other borrowing costs. According to the mortgage rate forecast for 2023, the rising current mortgage rates are making it more expensive to buy a home, and could dampen the housing market. However, some experts believe that the housing market is still strong enough to withstand the higher rates.

If you are considering buying a home, it is important to factor in the rising mortgage rates. You may want to consider locking in a rate now, before they go any higher. You should also shop around and compare rates from different lenders.

What is a good mortgage interest rate?

Selecting the perfect mortgage rate tailored to your unique financial circumstances is a decision that requires careful consideration. Various options are available, each carrying its own set of advantages and considerations. Opting for a home loan with a shorter term often grants the borrower a lower interest rate, but the flip side is a higher monthly payment. On the other hand, embracing an adjustable interest rate may offer an initially lower rate, with subsequent adjustments occurring annually after a predetermined timeframe. For example, a 7-year ARM adjustable-rate mortgage) has an unchanged rate for the initial 7 years and that eventually adjusts annually to accommodate variations in the loan’s remaining life. While a 30-year fixed-rate mortgage holds the rate constant for the entire lifespan of the loan.

How to get the best mortgage for you in 2023?

In the ever-changing landscape of the mortgage market in 2023, finding the best mortgage rate requires careful consideration and savvy decision-making. The difference in rates can have a significant impact on your overall interest costs, potentially saving you tens of thousands of dollars over the life of your loan. To help you navigate this complex terrain and secure the best mortgage rate for your new home loan, here are some tactics to consider:

- Shop around for a lender: While it may be tempting to stick with the lender recommended by your real estate agent, it’s important to explore other options. Don’t be afraid to ask for recommendations from trusted sources or use online tools to find lenders that specialize in loans tailored to your specific situation. Casting a wider net increases your chances of finding a lender who can offer you the most favorable mortgage rate.

- Compare lender fees: Mortgage interest rates are not the only factor to consider when choosing a lender. Each lender also has their own set of fees and closing costs that can significantly impact the total cost of your home loan. To ensure you’re getting the best deal, compare official Loan Estimates from at least three different lenders. Look for lenders with the lowest rates and APRs, as these indicators are key in determining the overall cost of your loan.

- Increase your down payment: Did you know that the size of your down payment can affect your mortgage rate? Mortgage rates are often tiered, with lower rates typically offered to borrowers who can make a down payment of 20% or more. If possible, consider increasing your down payment to qualify for a lower interest rate. Consult with your lender to see how a larger down payment could potentially reduce your mortgage rate and save you money in the long run.

- Improve your credit score: Your credit score plays a crucial role in determining the mortgage rate a lender offers you. Generally, the higher your credit score, the lower the interest rate on your home loan. Before applying for a mortgage, take the time to review your credit score and take steps to improve it if necessary. Paying bills on time, reducing debt, and keeping credit card balances low are all ways to boost your credit score and potentially secure a more favorable mortgage rate.

- Consider different types of mortgage loan rates: While the 30-year fixed rate mortgage is the most common choice, it may not always be the best option for everyone. Depending on your specific needs and financial goals, alternative mortgage options may be more advantageous. For example, adjustable-rate mortgages (ARMs) typically offer lower initial interest rates compared to fixed-rate mortgages, but the rate can adjust after a certain period of time. On the other hand, a 15-year fixed rate mortgage may offer a lower interest rate overall, but it comes with higher monthly payments. Take the time to carefully consider your options and choose the home loan that aligns with your financial circumstances and long-term plans.

By following these tactics and taking the time to explore your options, you can increase your chances of finding the best mortgage rate in 2023. Remember, the journey to securing the best rate requires diligence, research, and a willingness to consider different paths. With careful planning and informed decision-making, you can unlock the door to a mortgage rate that aligns with your financial goals and sets you on the path to homeownership success.